Why Choose

Coast Central?

The Coast Central Difference - Where YOU are central.

You’re in Control

At Coast Central, we make banking easy, with access to your finances – anytime. With a network of over 30,000 free ATMs nationwide, the latest digital banking solutions, and 11 convenient Member Services Branches, one open Monday through Saturday and another open 7 days a week and evenings, control your funds from anywhere you happen to be.

Exceptional Service

We’re all about exceptional service. Our dedication to providing a personalized member experience means your individual growth and our thriving community go hand in hand. At Coast Central Credit Union, we are dedicated to helping our members achieve their version of financial success. We support the financial success of individuals, businesses, and community organizations throughout Humboldt, Del Norte, and Trinity counties. With a wide range of top-notch personal and business products, competitive rates and fees, and friendly, caring community advocates, we strive to make a difference every day because our members are central.

Community Commitment

Do you care about your community? So do we! As a member of Coast Central, you directly support $400,000 annually in community giving to deserving local non-profits such as CASA, Senior Resource Center, Food for People, Special Olympics, fire relief, Little League, youth soccer, and much more. Additionally, Coast Central employees volunteer thousands of hours each year throughout our tri-county region.

Open to Dream

Commitment to Community

Make your Dreams a Reality

With you 24/7

Ready to be a member?

Join TodayCoast Central Credit Union's Core Values

Our Mission Statement

To be the primary financial institution for members by providing high quality financial services, at competitively favorable rates, consistent with maintaining financial strength.

Our Value Statement

To fulfill our mission we recognize as essential and value…

by creating and maintaining a positive work environment and the importance of the contributions that each employee, both individually and collectively, has to offer.

Our Members:

by placing you at the forefront of the decision-making process, seeking your input and responding to your needs.

Our Community:

by encouraging our staff to participate in community affairs and by providing financial support.

Our Quality Service Guarantee

As Coast Central Credit Union employees, we will provide our members with quality service that exceeds expectations. We will provide a professional and welcoming environment for our members along with locations and hours that meet your needs. We will be knowledgeable in our credit union’s products and services and provide accurate and timely transactions for our members. We will create lasting relationships with our members by welcoming our members with a friendly greeting, a smile, and eye contact; thanking our members and calling them by name; wearing our name tags at all times; and dressing in a professional manner. We will strive to assist fellow employees in providing excellent service through teamwork and dedication.

Our History

History can be defined as “the whole series of past events connected to particular people”. For Coast Central Credit Union, the people connection is intrinsic in the events that make up our past. In fact, since 1950, the credit union motto of people helping people has been at the forefront of everything we do. So join us on a journey through the past to experience the formation of a non-profit cooperative that grew into a homegrown success based on an extraordinary element: YOU.

1950-1969

1950: Humboldt County Employees Federal Credit Union (HCEFCU) was formed.

1950: Humboldt County Employees Federal Credit Union (HCEFCU) was formed.

1959: Klamath-Trinity Community Credit Union was formed in Hoopa.

1968: HCEFCU opened an office at 5th and O Streets, Eureka.

1970-1989

1973: Steve Antongiovanni named President/CEO.

1973: Steve Antongiovanni named President/CEO.

1974: HCEFCU pledged $25,000 share deposit in new Redwood Central Credit Union.

1975: HCEFCU celebrated its 25th anniversary and completed merger with Medical Employees Federal Credit Union.

1976: NCUA approved name change of HCEFCU to Coast Federal Credit Union.

1977: Coast Federal opened an office in Crescent City.

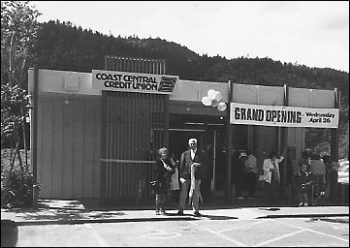

1978: Coast Federal opened an office in Valley West Shopping Center, Arcata.

1978: Klamath-Trinity Community Credit Union merged with Redwood Central Credit Union.

1979: Coast Central Credit Union (CCCU), a state and community-chartered organization, was officially formed on July 18, which merged Redwood Central (a state-chartered credit union) and Coast Federal (a federally chartered credit union). Membership encompassed all of Trinity and Del Norte counties and a portion of Humboldt County.

1980: Arcata Plywood Federal Credit Union merged with Coast Central Credit Union.

1981: Opened offices on Harrison Avenue, Eureka and on Main Street, Fortuna.

1981: Trinity Alps Community Credit Union merged with Coast Central Credit Union.

1981: Expanded with an office in Trinity County – Weaverville

1984: Became a California corporation on March 19.

1986: Established the college scholarship program for high school seniors in its service area.

1987: Opened an office at 4th & J streets, Eureka.

1988: Opened an office in Bayshore Mall, Eureka, offering seven-day service and expanded hours.

1989: Opened an office in Hoopa, originally operating out of a motel room.

1989: Began a network of “Automatic Teller Machines” (ATMs), offering members 24-hour instant access to cash, becoming the first financial institution to have ATMs in local Safeway and Co-op stores.

1989: Opened an office in Willow Creek.

1989: Reached $100 million in assets.

1990-2009

1990: Dean G. Christensen named President/CEO, taking over for retiring Steve Antongiovanni. During Steve’s tenure with CCCU, 6 offices were opened and assets grew from $150,000 to more than $125 million.

1990: Dean G. Christensen named President/CEO, taking over for retiring Steve Antongiovanni. During Steve’s tenure with CCCU, 6 offices were opened and assets grew from $150,000 to more than $125 million.

1994: Community charter expanded to include all of Humboldt County, officially serving all of its tri-county area.

1997: Introduced online banking, one of the first 50 credit unions in the country to do so.

2000: 50 years of serving members and communities!

2001: Recognized for the first time as “Best Bank or Credit Union on the Northcoast” by readers of the Times-Standard.

2003: Theme of “Belonging Never Felt Better” introduced.

2007: Opened Member Support Center and Member Services Branch on Central Avenue in McKinleyville in June.

2008: Received “Best Real Estate Lender on the Northcoast” award for the first time by Times-Standard readers.

2008: Recognized by readers of the Del Norte Triplicate for the first time as “Best Financial Institution”.

2008: Established the Community Investment Program, awarding $100,000 annually to non-profit organizations.

2009: Surpassed $800 million in assets.

2010-2019

2010: Opened 12th Member Services Branch in Arcata’s Uniontown Shopping Center

2010: Opened 12th Member Services Branch in Arcata’s Uniontown Shopping Center

2011: Awarded Arcata Chamber of Commerce’s “Business of the Year”.

2011: Reached $900 million in assets.

2012: Introduced Bill Pay and Mobile Banking to members.

2012: Recognized as “Best Investment Firm” for the first time by Times-Standard readers.

2013: Acquired Chetco Federal Credit Union’s California members and assets.

2014: Launched Coast Central Financial and Retirement Planning, supporting the CUNA Brokerage Services partnership.

2014: Awarded McKinleyville Chamber of Commerce’s “Business of the Year”.

2014: Received five awards in Times-Standard readers’ poll: Best Bank, Best Credit Union, Best Investment Firm, Best Mortgage Company, and Best Real Estate Lender.

2015: Celebrated 65 years of serving members and communities.

2015: Surpassed 60,000 members, one third the population of the tri-county region.

2016 Reached 65,000 members and $1.28 billion in assets.

2017: Began construction on a new Eureka Downtown location to replace 4th and J office.

2017: Dean G. Christensen retired in October after serving for 28 years, 27 as President/CEO. Membership grew from 26,000 to over 66,000.

2017: After a history with CCCU for 36 years, James T. Sessa named President/CEO in October following Dean’s retirement.

2017: Awarded Eureka Chamber of Commerce’s “Business of the Year”.

2018: Opened new full service office in Eureka at 4th and F streets, moving Member Services from 4th and J and moving Member Business Services and Financial and Retirement Planning teams.

2018: Opened new full service office in Eureka at 4th and F streets, moving Member Services from 4th and J and moving Member Business Services and Financial and Retirement Planning teams.

2018: The closure of Ray’s Food Place in McKinleyville brought the closure of the Member Services Branch there. As a result, the McKinleyville Central location expanded to evenings and seven days a week.

2018: Signed contract with Corelation in San Diego to upgrade to a new core computer system in November 2019 for the first time in 30 years.

2019: Added another VP position: Member Digital Services, responsible for Online & Mobile Banking, Card Services, and Member Support Center.

2019: After nearly 40 years on the Board of Directors, Robert Gearheart retired, and Peter Pennekamp joined the Board. Robert was named Director Emeritus.

2019: Successfully completed the core system upgrade to Corelation/Keystone in November 2019, the first upgrade for CCCU in over 30 years.

2020-Present

2020: For the 19th consecutive year, recognized by Times-Standard readers as “Best Credit Union” and for the last five years, “Best Place to Get a Loan.”

2020: The COVID-19 pandemic affected components of daily life throughout the world and temporarily closed our Bayshore Mall location for nearly three months and significantly reduced other MSB hours due to health and safety precautions. All employees and members mandated to maintain 6-foot distance and wear facial coverings starting in April.

2020: After nearly 30 years on the Board of Directors, Joyce Jury retired, and Klark Swan was appointed.

2021: Reached $2 billion in assets in April.

2021: As of April, over 42% of individuals living in our tri-county area were members.

2021: COVID-19 effects continued, including required facial coverings and social distancing, however by April, vaccines readily available in our service areas. The entire Senior Management team and roughly 1/3 of staff fully vaccinated by May.

2021: Named by Del Norte Triplicate Readers’ Choice as “Best Financial Institution” for 15th consecutive year, Times-Standard’s “Best Credit Union” for 20th year in a row, and North Coast Journal’s “Best Bank/Credit Union” for 8th consecutive year.

2021: Recognized by Rotary District 5130 with a North Coast Ethics in Business Award for commitment to employees and members during the pandemic. The district stretches north to the Oregon border and south to Petaluma.

2021: Coast Central was a sponsor of the US Capitol Tree, which for the first time in history hailed from Trinity County. CEO Jim Sessa and CFO Fred Moore traveled to Washington, D.C. for the lighting, which was done by a Crescent City 5th grader whose parents are CCCU members.

2022: In February, the State removed the requirement for face coverings for fully vaccinated individuals indoors, and in March for all, though face coverings and social distancing continued to be recommended.

2022: Introduced a ChatBot, “Owlbert the Know-it-Owl,” available at coastccu.org that answers individuals’ general questions. An employee in Member Support created the name.

2022: Named “Best Credit Union” by Times-Standard readers for 21st consecutive year

2022: Conversion from CUNA Mutual to LPL Financial for Coast Central Financial & Retirement Planning, the first since the brand was launched in 2014.

2023: After serving 9 years, Robin Bailie retired from the Board, and Rees Hughes won the election to serve.

2023: Named Best Bank/Credit Union by North Coast Journal readers for 21st consecutive year.

2023: Matt Wakefield, Terry Meierding, and Dane Valadao were appointed on the Board, replacing Peter Pennekamp, Klark Swan, and Louis Bucher, and later elected by the membership in 2024.

2024: Completed an Online & Mobile Banking system upgrade to Access Softek in March.

2024: VP Strategic Initiatives John Gracyalny retired in June, after over 5 years.

2024: Major expansion of our Fortuna location completed and ribbon cutting held in June.

Board of Directors

Coast Central is led by an unpaid, volunteer Board of Directors, composed of nine member-owners of the credit union. Additionally, we have a volunteer Supervisory Committee. All 12 individuals’ experience and leadership abilities provide oversight that helps guide Senior Management and keep the organization strong.

Board of Directors

Ron Rudebock, Chairman

Denise Jones, Vice Chair

Brendan McKenny, Treasurer

Kelly Walsh, Secretary

Rees Hughes

Terry Anne Meierding

Dane Valadao

Matthew Wakefield, CPA

Supervisory Committee

Paula Mushrush, Chair

Amy Eberwein

Kate Lancaster

Contact Us